The long-running debate around State Pension age changes affecting women born in the 1950s has once again returned to public focus, as real-life stories continue to underline the human impact behind policy decisions. Campaigners argue that these cases show how pension reforms, while lawful, have left many women facing financial pressure, declining health, and little choice but to remain in work far longer than expected.

What the WASPI Campaign Represents

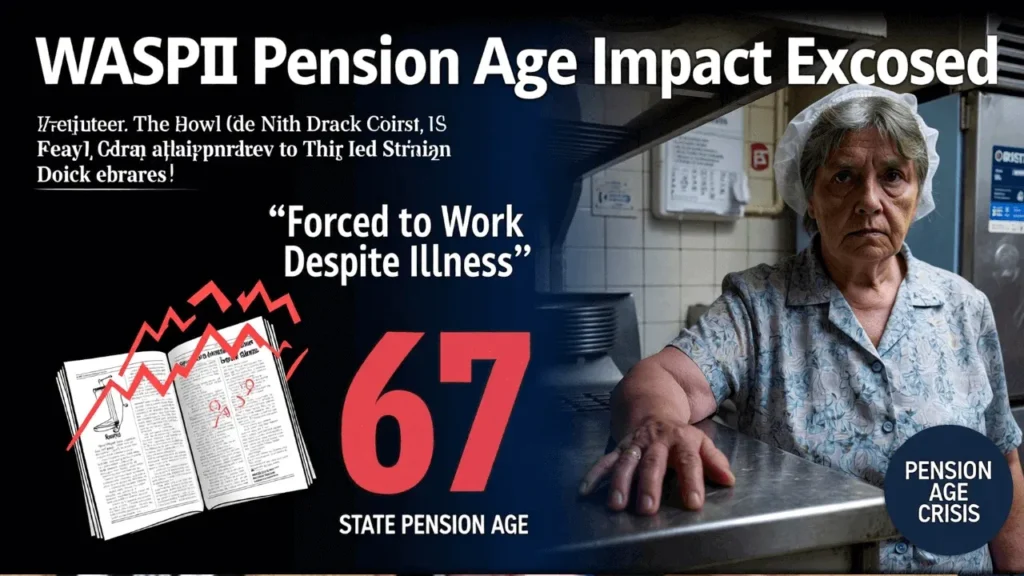

The Women Against State Pension Inequality (WASPI) campaign speaks for women born in the 1950s who were affected by changes to the UK State Pension age. Many expected to retire at 60, based on the rules that applied for much of their working lives.

While the campaign does not oppose pension age equalization between men and women, it argues that the changes were introduced too quickly and communicated poorly. As a result, thousands of women say they were denied sufficient time to adjust their retirement plans.

How State Pension Age Changes Were Introduced

Historically, women in the UK were entitled to claim the State Pension earlier than men. Legislation passed during the 1990s and 2000s gradually equalized and then increased the pension age for both sexes.

The policy aim was to reflect increased life expectancy and maintain the long-term sustainability of the pension system. However, critics say the speed of implementation failed to account for how close many women already were to retirement.

Why Communication and Notice Are Central Issues

Effective retirement planning relies on long-term certainty. Women affected by the changes often report that they received little or no direct notification, leaving them unaware of delays of several years.

Campaigners argue that insufficient notice removed the opportunity to save more, retrain, or adjust work and health decisions. This lack of preparation continues to shape the hardship many now face.

The Reality for Women in Manual and Caring Roles

A significant number of affected women spent their careers in lower-paid or physically demanding jobs. Roles such as catering, cleaning, retail, and care work often involve long hours on one’s feet, heavy lifting, and repetitive physical tasks.

Continuing in these roles into later life can be extremely challenging, particularly for women with arthritis, heart conditions, or other chronic illnesses.

Why Personal Stories Resonate So Strongly

Individual experiences help translate complex pension policy into real-world consequences. Stories of women working through illness highlight the gap between policy intentions and lived reality.

These accounts resonate with the public because they reflect concerns shared by many approaching retirement age, particularly those without substantial savings.

The Case of a School Dinner Lady Still Working

Examples involving school dinner ladies have drawn particular attention because the role is widely understood as physically demanding. Daily tasks include prolonged standing, lifting heavy equipment, and working under time pressure.

For women coping with health conditions, continuing in such roles can take a serious toll on both physical and mental wellbeing.

Illness and the Pressure to Keep Working

Women affected by delayed pension access may not qualify for full financial support if they are assessed as capable of some form of work. This can force them to remain employed despite medical challenges.

The stress of ongoing financial insecurity can also worsen existing health problems, creating a cycle that is difficult to break.

Why Early Retirement Is Often Not Possible

There is a common assumption that affected women can simply retire early. In practice, early retirement usually results in reduced income and reliance on limited personal savings.

For many, this option is financially unrealistic, particularly given rising living costs.

The Role of Savings and Private Pensions

Lower lifetime earnings and career breaks for caring responsibilities mean many women have smaller private pension pots. This makes the State Pension a vital source of financial security.

When access to that income is delayed, financial pressure increases significantly.

Benefits and the Gap Before Pension Age

Some women turn to working-age benefits while waiting for their State Pension. However, benefit systems are often complex and demanding, particularly for older claimants.

Assessments and conditional requirements can add further stress during an already difficult period.

Government Responses and Ongoing Frustration

Successive governments have acknowledged shortcomings in communication but have consistently stated that the pension age changes were lawful. To date, no broad compensation scheme has been implemented.

This position has led to frustration among campaigners, who argue that legality does not negate harm.

The Importance of Health in the Debate

Health becomes less predictable with age, and policies assuming extended working lives do not always reflect this reality. For those already dealing with illness, delayed pension access can be especially damaging.

Campaigners argue that fairness must consider health as well as financial sustainability.

Why These Stories Continue to Matter

Personal accounts keep the issue visible and remind policymakers that behind every statistic is a real person. They help ensure the debate remains grounded in human experience.

Without these voices, the impact of pension age changes risks being overlooked.

My name is Arsam, and I am the founder and author of Mymct. I created this website to share reliable mobile technology updates and important news in a simple and easy-to-understand way. I have a strong interest in smartphones, mobile apps, and the fast-changing digital world, and I enjoy researching topics that are useful for everyday users.